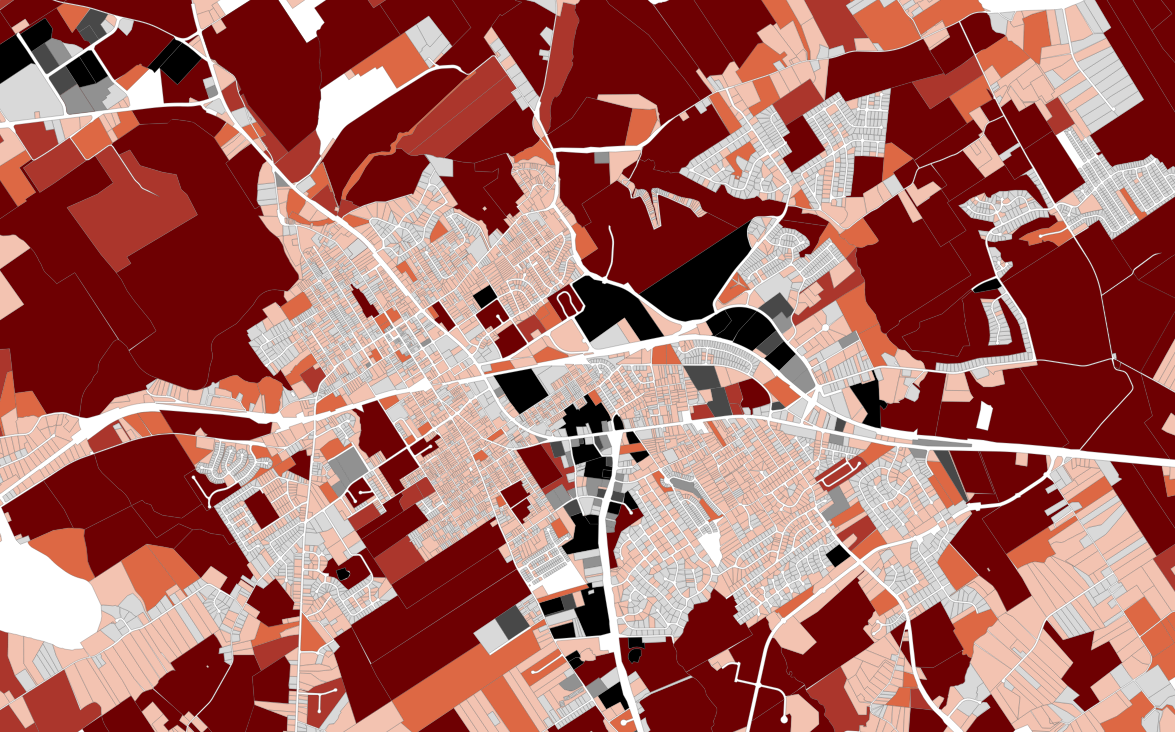

Is your city living within its means?

Financial Principles for Building Municipal Wealth: Part 1 — Living Within Your Means

Cities thrive when they follow the same basic financial principles many households follow: spend within your means, prioritize needs over wants, prepare for downturns, and invest for long-term value. This is the first of a four-part series on how land use affects each principle.

Cities, like households, need to live within their means. Most cities understand this at least at a basic level. However, living within their means is more than just avoiding vanity projects and wasteful spending. Often, it means passing up on investment “opportunities.”

Let me elaborate with an example in personal finance. Homes are traditionally seen as great assets and worthwhile investments. They serve an essential function as shelter and allow their owner to build wealth. However, they can be quite costly when expenses like mortgage payments, routine maintenance, utilities, and property taxes are added up.

That said, only people who understand the costs and are financially ready should buy a house.

So, back to municipal finance… Infrastructure serves an essential function in communities and helps cities build wealth, making it a valuable asset and a worthwhile investment. However, it too can be quite costly — first to build, then to maintain, and eventually to replace.

Because of this, cities should only build new infrastructure that they know they can pay for both now and in the future.

However, many cities build new infrastructure without fully considering maintenance and replacement costs, setting themselves up for failure.

Several years after initial construction, deterioration becomes visible and worsens as the city doesn’t have the money for repairs.

This is many cities’ first failure to live within their means.

But it doesn’t stop there. As existing infrastructure deteriorates, many cities acquire new infrastructure liabilities, either by intentionally building it themselves or allowing a developer to build it and pass maintenance on to the city. This makes as much sense as someone buying new investment properties when the house they live in is falling apart.

As cities take on more and more infrastructure “investments,” they spend farther and farther outside of their means, moving them closer to insolvency.

But there are ways to prevent this and even mitigate this after it happens… Don’t build infrastructure until you need it. Concentrate value around existing infrastructure until revenue exceeds costs. Prioritize maintenance in high-value areas over low-value areas.

Regardless, accounting for the long-term costs of infrastructure can go a long way in building resilient community wealth. Failing to do so can lead to financial disaster. Make sure your city is living within its means.

If you would like additional guidance in

managing your community’s infrastructure costs, schedule a consultation with us today!